Investment Center Managers Are Usually Evaluated Using Performance Measures

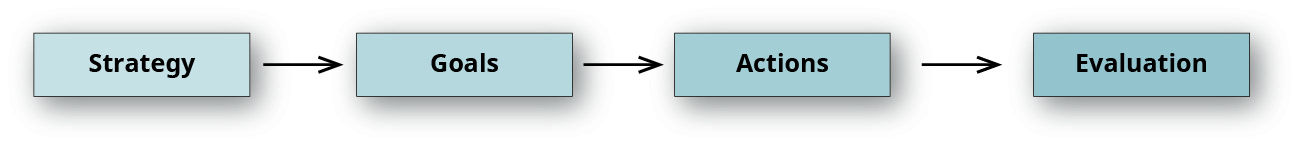

Investment center managers are usually evaluated using performance measures. Understand the balanced scorecard approach of performance measurement by linking strategy objectives and performance measures into financial customer internal business process and learning and growth.

Explain The Importance Of Performance Measurement Principles Of Accounting Volume 2 Managerial Accounting

ROI Investment cneter income Investment center averge invested assets.

. ROI is derived by dividing the income return by investment RI is the difference between income and expected target return and economic value added EVA is the difference between after-tax earnings and. ROI Disadvantages or Limitations. Organizations usually use accounting numbers to calculate ROI.

Since managers are usually evaluated more frequently than is the economic health of their investment centers and since including non-controllable items in. They are based on return on investment. What type of risk management is Beth practicing.

Return on investment is the key performance measure in an investment center. Investment Center The manager of an investment center has control over cost revenue and investments in operating assets. Investment center managers are evaluated on their use of investment center assets to generate income controllable versus uncontrollable costs we often evaluate a mangers performance using responsibility accounting reports that describe a departments activities in.

Asked Dec 24 2021 in Business by Lorra. If managers are evaluated using return on investment they are often over aggressive of accepting new investments because the investment will provide an increase in net income. Investment managers are typically evaluated using performance measures that combine income and assets such as.

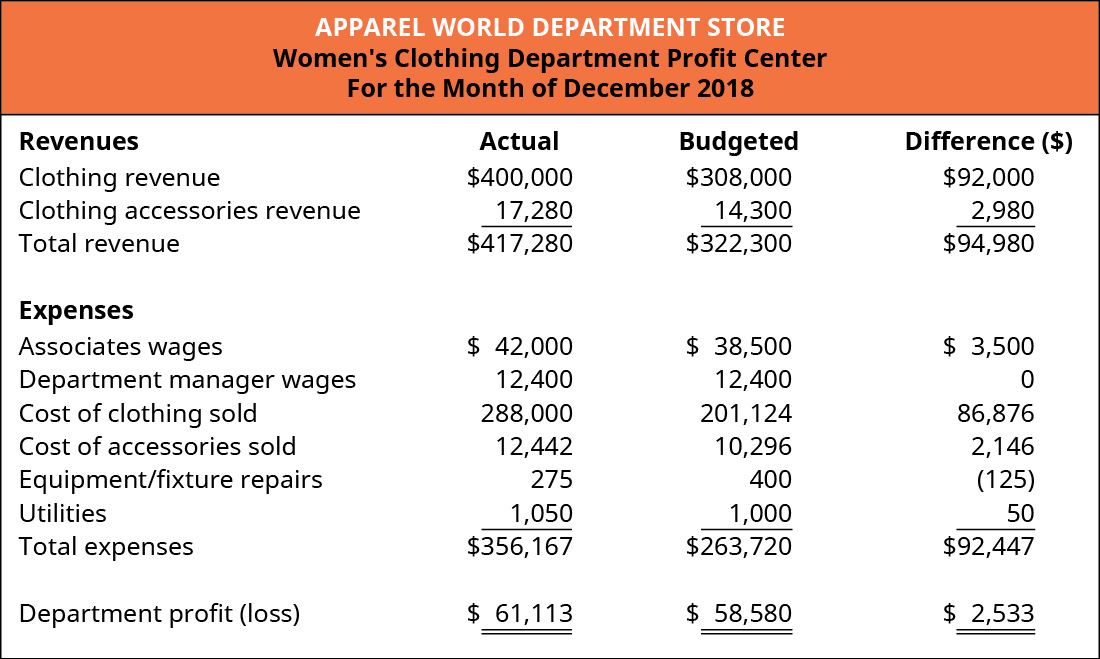

Thus executives and senior managers are often investment center managers. Many large companies still measure the financial performance of their profit center managers with techniques developed in the 1920s. For example a manager.

Asked Sep 19. - Return on Investment ROI. One disadvantage of evaluating performance using return on investment is that assets are measured at their market value.

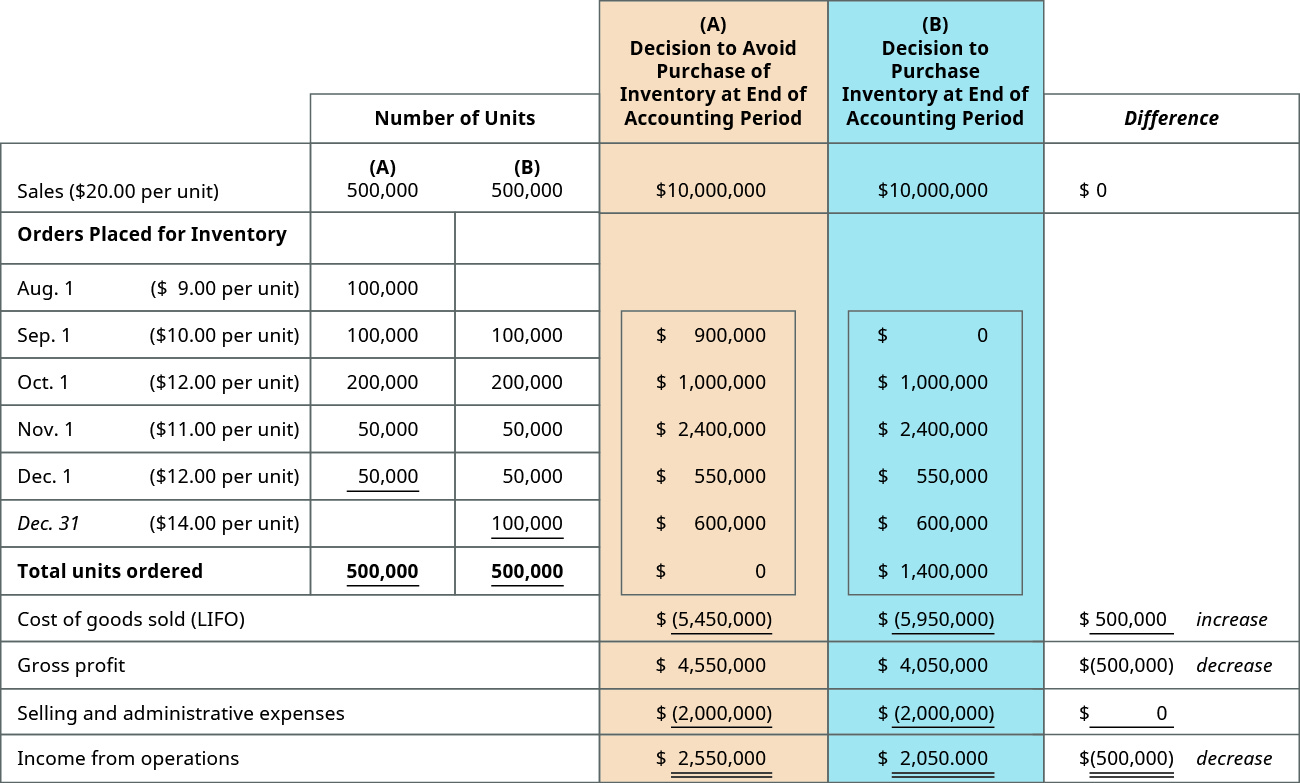

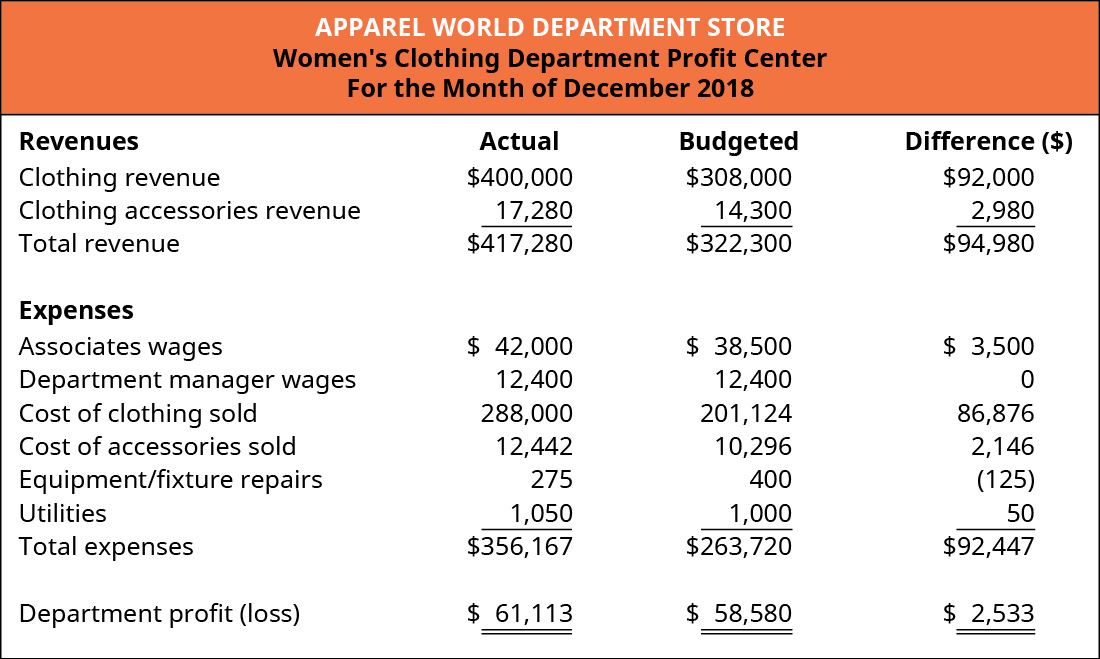

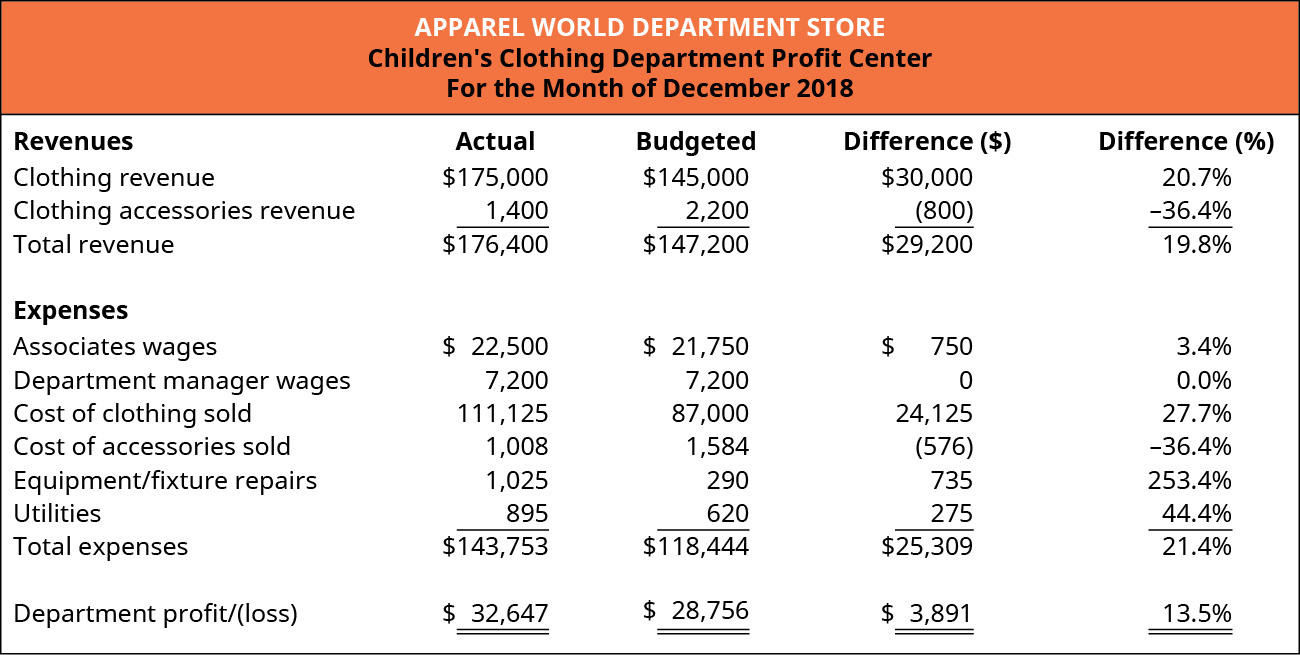

For example if ROI is the performance criterion a division manager will only invest in new projects that will result in an increase in hisher divisions ROI. Because performance measures are used to reward performance managers use them as decision criteria when they evaluate alternative courses of action. A unit of a business that generates revenues and incurs costs is called a profit center A report that accumulates the actual expenses that a manager is responsible for and their budgeted amounts is a responsibility accounting performance report Investment center managers are usually evaluated using performance measures that combine income and.

These numbers are usually monthly quarterly or annual and. Investment center managers are often evaluated using return on investment ROI or residual income measures. Return on investment ROI is a performance measure used to evaluate the efficiency of an investment or compare the efficiency.

It is a better test of profitability and is defined as. ROI is a rate computed by dividing a business units profits by its average total assets. Various techniques are used to evaluate the performance of the investment division such as return on investment ROI residual income RI economic value added EVA.

ROI is therefore subject to the numerous possible manipulations of the income and investment amounts. Return on investment residual income profit margin and investment trunover. Investment center performance is often evaluated using a measure called return on investment ROI which is defined as follows.

Understand the use of return on investment ROI residual income RI and economic value added EVA. Investment center managers are typically evaluated using performance measure that combine income and assets False Return on investment is a useful measure to evaluate the performance of a cost center manager. Net operating income is income before taxes and is sometimes referred to as EBIT earnings before interest and taxes.

Important Methods of Investment Center Performance Evaluation. When calculating RI for a manager of a segment the income and investment definitions should be income controllable by the manager and assets under the control of the segment manager. Return on Investment ROI The most common measure of investment center performance evaluation is the return on investment.

A manager of a cost center is evaluated mainly on. In evaluating the performance of a segment or a segment manager comparisons should be made with 1 the current budget 2 other segments or managers within the company 3 past. Some of the important investment center performance evaluation measures are.

While ROI is a popular performance measure used to evaluate investment centers it has some disadvantages. The luxury cars of responsibility centers because they feature everything.

Cost Centers Profit Centers Investment Centers Video Lesson Transcript Study Com

Measuring Investment Center Performance

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Measuring Investment Center Performance

Measuring Investment Center Performance

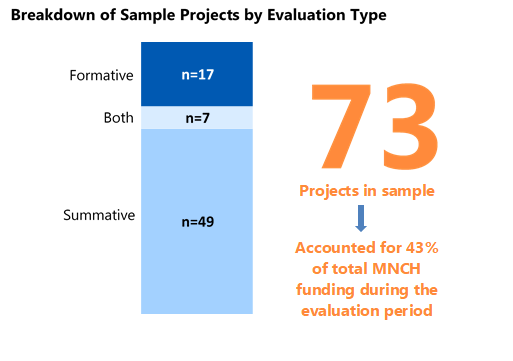

Final Report Evaluation Of The Maternal Newborn And Child Health Initiative

385747041 Mas 4 Mngt Advisory Services Chapter 9 Multiple Choice It Is A Subdivision Of Studocu

Final Report Evaluation Of The Maternal Newborn And Child Health Initiative

Measuring Investment Center Performance

Describe The Types Of Responsibility Centers Principles Of Accounting Volume 2 Managerial Accounting

Pdf Why Measure Performance Different Purposes Require Different Measures

The Complete Guide To Strategy Evaluation With Techniques Templates

Measuring Investment Center Performance

Explain The Importance Of Performance Measurement Principles Of Accounting Volume 2 Managerial Accounting

Measuring Investment Center Performance

Training Evaluation The Process Of Evaluating Training Programs

Measuring Investment Center Performance

Call Center Quality Assurance 12 Expert Tips And Best Dialpad

Solved Investment Center Managers Are Typically Evaluated Chegg Com

Comments

Post a Comment